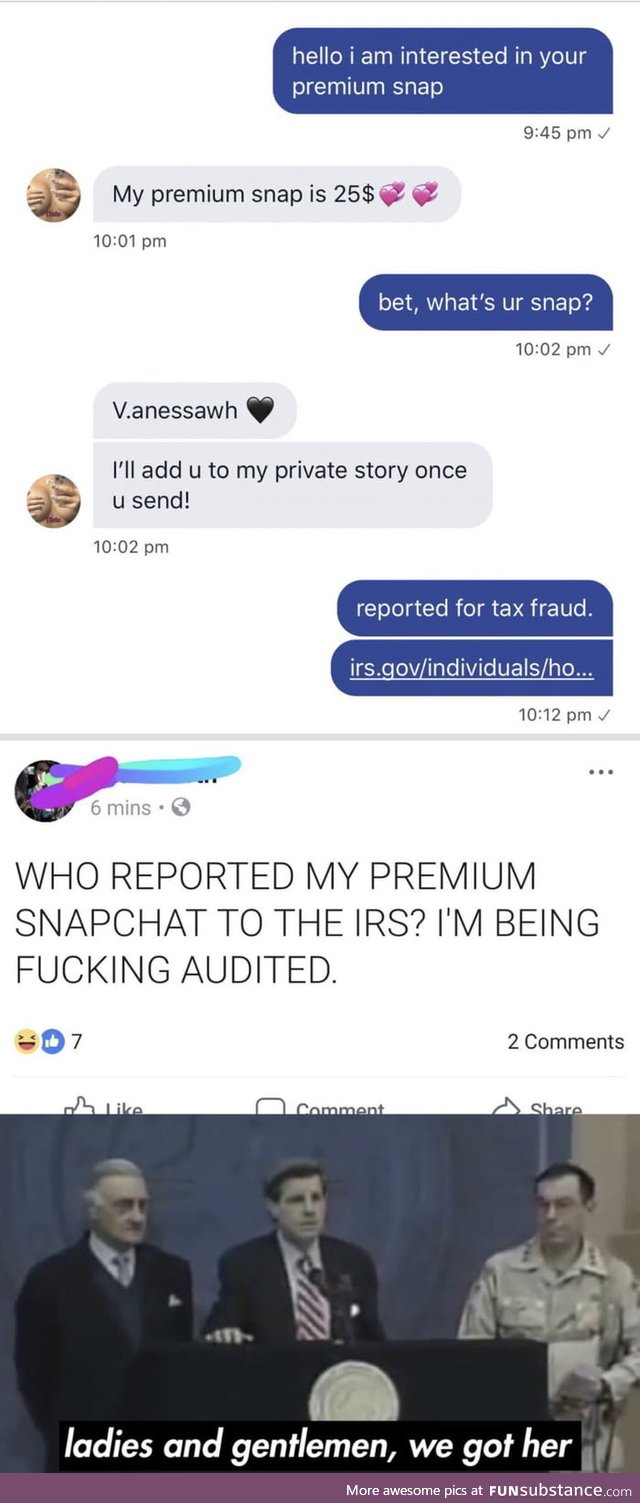

It's time for all of us to do our part

6 years ago by ulias · 341 Likes · 3 comments · Trending

Report

Comments

Follow Comments Sorted by time

guest_

· 6 years ago

· FIRST

X doubt. The IRS uses form 3949A to report tax fraud or evasion. There are other ways but they all require a few things. You must have the true name and address of the person or business which you are reporting. You must also have a substantial amount of personal information about them as well, and some type of documentation to the nature of the fraud. This is both because in order to meet the burden of proof to investigate an individual the IRS requires some actual proof that they are defrauding the government, and some proof that you know enough about their finances to make a valid report; and to prevent using the IRS to “grief” people and waste their time and money. The fact she is accepting money online doesn’t prove or even indicate she isn’t reporting on her taxes. There is no basis to assume evasion from those captures, and it STILL wouldn’t be evasion unless 1. The person actually paid, and 2. They waited until the next taxes were so. BUT! This is why you need VERY DETAILED...

5

guest_

· 6 years ago

... information- you don’t acrually have to do your taxes. That’s right. If you don’t owe money, you can wait until 2020 to submit your taxes for 2018 if you wanted without penalty. Penalties are only assessed on taxes owed. So the webcam girl- does she own a home? Stocks? An electric car? Does she have kids? How many? Another job? Does she donate to charity? What about 401k or Roth IRA? Let’s say she has no side job. So 100% of her online income is taxable with no tax deducted. Ok. Let’s say she makes $100k+ a year. Ok. Well... if she has homebuyer or “green” credits, charitable donations, itemized wrote offs as an independent contractor, if she writes off losses on properties or stocks- she could still owe no money. In other words- the IRS would waste a lot of time dealing with jealous exes and angry neighbors or distant family chasing false reports because taxes are more complex than “you owe money cause you made money...” oh- and while every dollar matters for taxes- even...

5

guest_

· 6 years ago

... technically if you find $1 on the street you are supposed to report it... generally speaking the IRS won’t audit or bother investigating below a certain amount because the penalties of any exist would be less than the cost to investigate and recover. Most people’s taxes won’t be effected by $70, their bracket and liability won’t effectively change unless they are literally on the edge of their limits. What’s more- to even file the report you need far more information than this person likely has available, and while audits tend to frighten people- most are routine investigations of minor discrepancies that end in an administrative correction or adjustment, and if the error doesn’t result in an amount owed no actual penalties are suffered. One can also redo previous taxes and retroactively apply certain credits or shift funds to another tax year to mitigate any tax burden. So I call BS.

5